What comes next after Bitcoin’s fourth halving? Continue reading to explore its economic and operational effects on the Bitcoin mining industry.

CryptoCaster Quick Check:

The Bitcoin halving, a critical event, is set for April 19, 2024. Occurring every four years, this event will slash the block subsidy for Bitcoin miners from 6.25 BTC to 3.125 BTC, effectively halving the reward miners earn for their work. Historically, these halvings have triggered significant changes in the mining landscape, potentially affecting numerous economic and operational aspects of Bitcoin mining.

MARKET PREDICTIONS AND THE ECONOMIC OUTLOOK

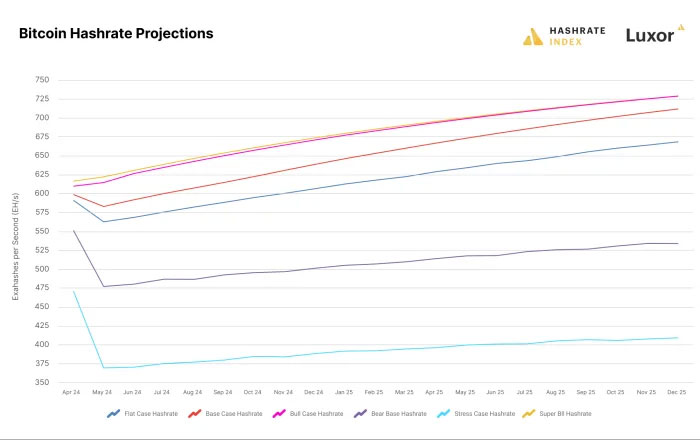

The immediate result of the halving is a significant drop in miner revenue because of the smaller block subsidy. As a result, less productive miners might become unprofitable and leave the network, which could cause the hashrate to drop. If Bitcoin’s price stays at its current level, roughly 3-7% of the hashrate could go offline, according to Luxor’s Hashrate Index Research Team. However, depending on how Bitcoin prices and transaction fees develop after the halving, up to 16 percent of the hashrate might lose its economic viability.

Stay in the know on crypto by frequently visiting Crypto News Today

A crucial component of Bitcoin security, hashrate, may change in tandem with difficulty levels to reflect the new economic conditions. According to Luxor’s analysis, there exist various scenarios wherein the network’s hashrate, which takes into account adjustments to the new earning potential following the halving, could ultimately range from 639 EH/s to 674 EH/s by year’s end.

BREAKEVEN POINTS AND SIMPLE PRICING

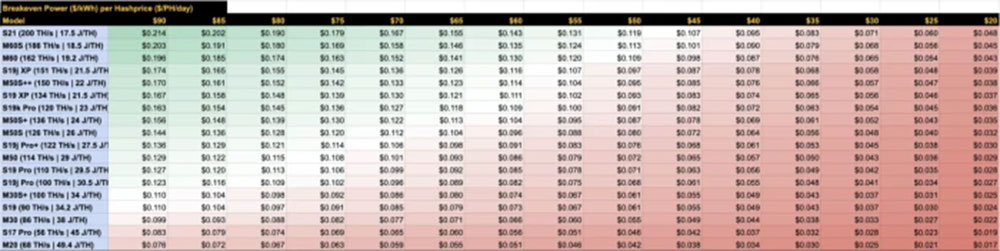

The profitability of various ASIC models will become important after the mining reward is cut in half. If the price of Bitcoin does not rise significantly, only the most productive machines will be able to make a profit due to the lower rewards. Luxor, for example, projects that breakeven power costs for next-generation ASICs, such as the S19 XP and M30S++, could vary from $0.07/kWh to $0.15/kWh, contingent on post-Halving hashprice.

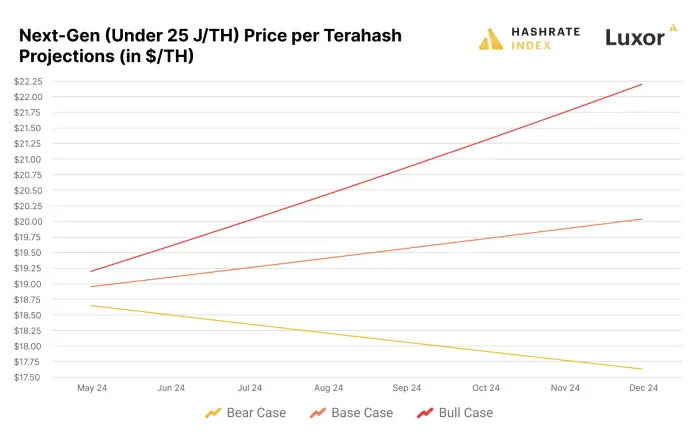

ASIC machine prices will probably increase as a result of this shift in profitability. Because of the strong historical correlation between hashprice and ASIC prices, a decrease in hashprice is expected to cause a corresponding adjustment in ASIC values. This may hasten the models’ withdrawal from the market, especially the older, less effective ones.

THE POST-HALVING ROLE OF CUSTOM ASIC FIRMWARE

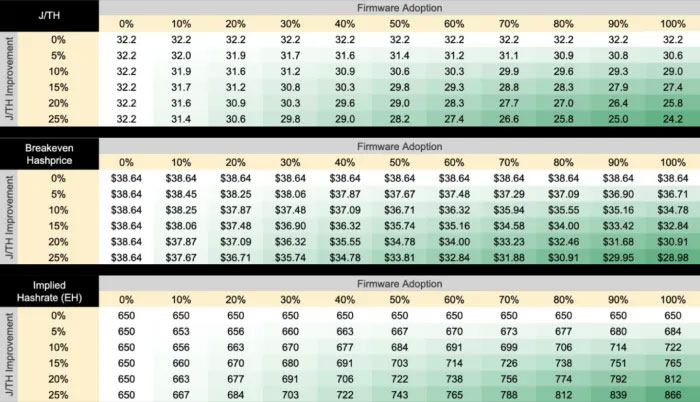

Miners are increasingly using customized ASIC firmware to increase the hardware’s efficiency in an effort to combat declining profitability. Firmware such as LuxOS and BraiinsOS can improve machine performance by optimizing hashrate output and power consumption, thereby reducing the electricity breakeven point. By lowering its power consumption, underclocking an S19 with customized firmware, for instance, could increase its operational viability and sustain profitability even at lower hash rates.

Custom firmware is becoming more and more popular among public miners as a way to increase fleet efficiency. Businesses that have reported improving their operational efficiencies through the use of custom solutions include CleanSpark and Marathon. It is anticipated that this trend will intensify as more miners look to reduce expenses and increase output in the face of declining block rewards.

The 2024 Bitcoin Halving and What Follows

Like previous halvings, the 2024 Bitcoin Halving is expected to drastically alter the mining environment. Even though the precise results are unknown, there is no doubt that the event will bring opportunities as well as challenges. Miners who strategically plan, considering both operational efficiencies and economic forecasts, will be in a better position to handle the post-halving environment. In order to turn the halving event into an opportunity rather than a setback, those in the Bitcoin mining industry will need to remain knowledgeable and flexible. Even in tighter economic times, miners can prosper with the correct preparations, especially in ASIC management and firmware optimization.![]()

We hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting CryptoCaster’s journalism.

From Elon Musk, Larry Fink(BlackRock) to Jamie Dimon(JP Morgan Chase) a number of billionaire owners have a powerful hold on so much of the hidden agendas’ which eludes the public concerning the paradigm shift juxtaposed by cryptocurrency and web3 emerging technologies. CryptoCaster is different. We have no billionaire owner or shareholders to consider. Our journalistic efforts are produced to serve the public interest in crypto development and institutional disruptions – not profit motives.

And we avoid the trap that befalls much U.S. and global media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality and retail consumer protection. While fairness and transparency dictates everything we do, we know there is a right and a wrong position in the fight against fiat global banking interest and monetary reconstruction precipitated by the emerging crypto ecology.

When we report on issues like the FTX, Binance and Ripple crisis, we’re not afraid to name who or what is uncovered. And as a crypto sentinel, we’re able to provide a fresh, outsider perspective on the global monetary disruption – one so often missing from the insular American and European media bubble.

Around the world, readers can access the CryptoCaster’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news and information, or not.

We thankyou for the on-going support our readers have bestowed monetarily. If you have not considered supporting CryptoCaster, if you can, please consider supporting us just once from $1 or more of Bitcoin (satoshi) or Eth, and better yet, support us every month with a little more. Scroll further down this page to obtain CryptoCaster’s wallet addresses.

Thank you.

Kristin Steinbeck

Editor, CryptoCaster

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt

CRYPTOCASTER HEATMAP