Even in the event that a judge never gives his or her approval, the Justice Department maintains that it is “critical” that it be able to seize cryptocurrencies from Americans.

A previous study may provide insight into the potential practical applications of the Internal Revenue Service’s (IRS) proposal to expand bitcoin monitoring. In summary, the Department of Justice (DOJ) may soon have the means to begin seizing bitcoin at a never-before-seen rate, as the IRS is slated to monitor Americans’ cryptocurrency usage through an anticipated 8 billion new returns.

The problem originates from a report that the DOJ wrote in 2022 in response to Executive Order 14067. For those who may have forgotten, President Biden’s first significant cryptocurrency initiative was Executive Order 14067. Despite widespread initial fears of an imminent crackdown, the presidential order generally postponed making significant changes by first requesting reports from agencies to guide future regulations regarding cryptocurrencies and related matters.

The DOJ wrote the study, which addressed a wide range of subjects. The proposals, which mainly fell into four categories, were how to strengthen investigations, how to support prosecutions, how to stiffen penalties for crimes involving cryptocurrencies, and how to provide government workers more resources.

The DOJ’s defense of expanding its authority to take cryptocurrencies, however, is what makes this discussion so fascinating.

In order to discourage such conduct and deprive violators of their ill-gotten profits, the study, for instance, asserts that “it is critical that the United States have the authority to forfeit the proceeds of cryptocurrency fraud and manipulation.” Consequently, the DOJ suggests extending its jurisdiction over forfeiture in civil, criminal, and administrative contexts.

Stay in the know on crypto by frequently visiting Crypto News Today

The Department of Justice (DOJ) asserts that these revisions are required because the agency’s experience with cases involving cryptocurrencies has “exhibited limitations on the forfeiture instruments utilized to rob wrongdoers of their illicit gains and, in certain situations, return money to victims.”

However, given how much and how frequently the government has been able to take bitcoin over the years, this argument is hard to fathom. Actually, these examples are mentioned in the study itself. The FBI confiscated almost $427 million worth of cryptocurrency between 2014 and 2022. Between 2018 and 21 the IRS seized an additional $3.8 billion.

The DOJ’s claim that the US government is having difficulty obtaining cryptocurrencies is just not as convincing as the report’s suggestions suggest, given that over $4 billion is currently in circulation.

However, considering the massive surveillance that the IRS’s broker proposal is likely to produce, which might be used to begin seizing bitcoin at an even greater pace, it casts doubt on the DOJ’s study.

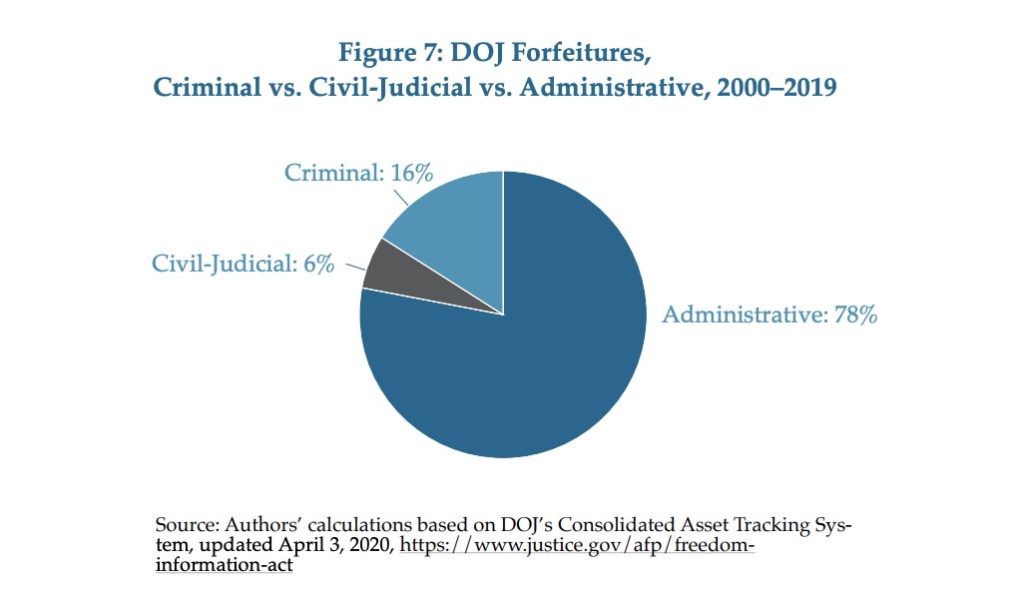

What’s known as administrative forfeiture is the issue. “Under ‘administrative’ or ‘nonjudicial’ forfeiture, the seizing agency — not a judge — decides whether a property should be forfeited,” as Nick Sibilla clarified in Forbes when the report first surfaced. Put another way, agents can seize property without having to convince a judge that a crime was committed.

CryptoCaster Quick Check:

This method discourages “undue burdens on the federal judicial system” and encourages the “efficient allocation of government resources,” according to the DOJ. When you consider that between 2000 and 2019, administrative forfeitures accounted for 78% of all forfeitures made by the DOJ, it appears that this procedure is its favorite method.

It’s feasible that the DOJ will “suddenly” discover enormous new areas for cryptocurrency seizure as a result of the IRS gathering copious amounts of fresh data on Americans’ cryptocurrency use. Once more, it’s critical to emphasize that the mere suspicion of a crime being committed is sufficient grounds for confiscations.

Stay in the know on crypto by frequently visiting Crypto News Today

Considering how frequently misconceptions about cryptocurrencies have made news, it’s easy to see how these kinds of fears may arise. For instance, a false report was used by over 100 members of Congress less than a month ago to demand a crackdown on cryptocurrencies.

Examining the IRS proposal in this context highlights one of the primary dangers associated with large-scale data collection. Massive government databases become attractive targets for both internal and external abuse, whether it’s the DOJ aiming to increase its seizure efforts, the IRS looking to increase audits, or a hacker looking for an exploit.

Users of cryptocurrencies should closely monitor how the IRS finally uses such data if it moves forward with its proposal.![]()

We hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting CryptoCaster’s journalism.

From Elon Musk, Larry Fink(BlackRock) to Jamie Dimon(JP Morgan Chase) a number of billionaire owners have a powerful hold on so much of the hidden agendas’ which eludes the public concerning the paradigm shift juxtaposed by cryptocurrency and web3 emerging technologies. CryptoCaster is different. We have no billionaire owner or shareholders to consider. Our journalistic efforts are produced to serve the public interest in crypto development and institutional disruptions – not profit motives.

And we avoid the trap that befalls much U.S. and global media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality and retail consumer protection. While fairness and transparency dictates everything we do, we know there is a right and a wrong position in the fight against fiat global banking interest and monetary reconstruction precipitated by the emerging crypto ecology.

When we report on issues like the FTX, Binance and Ripple crisis, we’re not afraid to name who or what is uncovered. And as a crypto sentinel, we’re able to provide a fresh, outsider perspective on the global monetary disruption – one so often missing from the insular American and European media bubble.

Around the world, readers can access the CryptoCaster’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news and information, or not.

We thankyou for the on-going support our readers have bestowed monetarily. If you have not considered supporting CryptoCaster, if you can, please consider supporting us just once from $1 or more of Bitcoin (satoshi) or Eth, and better yet, support us every month with a little more. Scroll further down this page to obtain CryptoCaster’s wallet addresses.

Thank you.

Kristin Steinbeck

Editor, CryptoCaster

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt

CRYPTOCASTER HEATMAP