Ethena Labs contends that markets outside the United States can explore new opportunities with financial instruments pegged to the U.S. dollar.

Stay in the know on crypto by frequently visiting Crypto News Today

For markets outside of the US, dollar-denominated financial instruments present a new opportunity. That is Ethena Labs’ wager, a business that has raised $14 million to develop a synthetic dollar based on Ethereum.

CryptoCaster Quick Check:

The funding was revealed by Ethena’s team on February 16 and was provided, among other investors, by Dragonfly, a venture capital firm. The business received $6 million from Binance Labs, Gemini, Bybit, OKX Ventures, Mirana Ventures, and Deribit in an earlier funding round in 2023 to establish decentralized finance systems based on the Ethereum network.

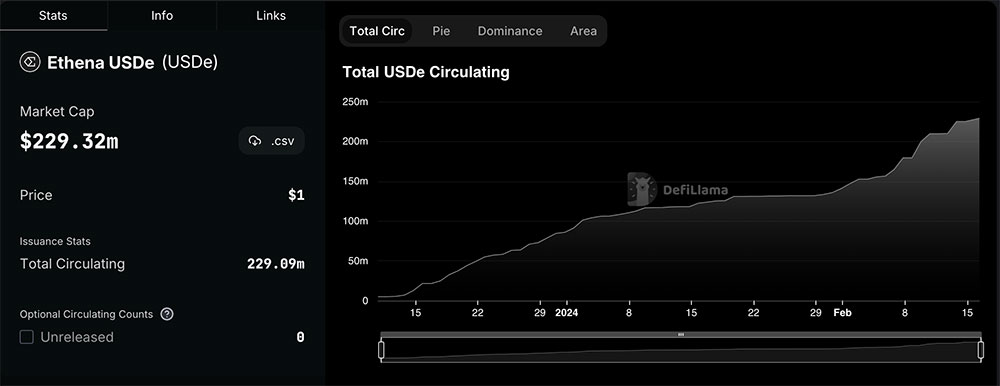

With staked Ether serving as collateral, the money will underpin the USDe, a synthetic dollar backed by delta-hedging techniques. DefiLlama data indicates that since the product’s inception in December, $200 million worth of value has been locked into it.

The company clarified in a statement, “USDe achieves its approximate peg to the U.S. dollar by utilizing delta-hedging on assets from users who mint USDe against short-staked Ethereum collateral, employing perpetual swaps to attain ‘delta-neutral’ stability.”

Put in a different context, USDe uses a variety of hedging techniques to keep its peg to the US dollar. It takes a different approach from traditional stablecoins, which employ direct collateral or computational ways to maintain its value, by using financial derivatives like arbitrage and perpetual swaps contracts to guarantee that the value of the digital currency stays constant with respect to the dollar.

In spite of issuers fully internalizing the yield, Guy Young, CEO of Ethena Labs, stated, “We view stablecoins as the single most important instrument within crypto and the only idea which has found true product market fit, with over $130bn of global demand.”

For example, Tether Holdings Limited, the largest stablecoin issuer, reported a “record-breaking net profit” of $2.85 billion in the final quarter of 2023, fueled by yields from its Tether

“The reliance of the entire sector on centralized stablecoins, whose collateral backing is held within the banking system, highlights the creation of a crypto-native synthetic dollar alternative as, in our opinion, the most significant opportunity in the field.”

However, the synthetic dollar is not risk-free only because it has delta-hedging. In times of market stress and unanticipated developments, counterparty risks and liquidity are always there. The startup says that in order to reduce these risks, institutional grade companies like Fireblocks, Copper, and Bitgo are holding and settling the collateral.

Tom Schmidt, general partner at Dragonfly, referred to the synthetic product as the “holy grail of crypto dollars.” He said, “Stablecoins have grown massively in popularity over the past few years by providing access to USD-denominated savings and remittances for people around the world, but they’ve always been handicapped by one of these three issues [stability, censorship, and capital efficiency].”![]()

We hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting CryptoCaster’s journalism.

From Elon Musk, Larry Fink(BlackRock) to Jamie Dimon(JP Morgan Chase) a number of billionaire owners have a powerful hold on so much of the hidden agendas’ which eludes the public concerning the paradigm shift juxtaposed by cryptocurrency and web3 emerging technologies. CryptoCaster is different. We have no billionaire owner or shareholders to consider. Our journalistic efforts are produced to serve the public interest in crypto development and institutional disruptions – not profit motives.

And we avoid the trap that befalls much U.S. and global media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality and retail consumer protection. While fairness and transparency dictates everything we do, we know there is a right and a wrong position in the fight against fiat global banking interest and monetary reconstruction precipitated by the emerging crypto ecology.

When we report on issues like the FTX, Binance and Ripple crisis, we’re not afraid to name who or what is uncovered. And as a crypto sentinel, we’re able to provide a fresh, outsider perspective on the global monetary disruption – one so often missing from the insular American and European media bubble.

Around the world, readers can access the CryptoCaster’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news and information, or not.

We thankyou for the on-going support our readers have bestowed monetarily. If you have not considered supporting CryptoCaster, if you can, please consider supporting us just once from $1 or more of Bitcoin (satoshi) or Eth, and better yet, support us every month with a little more. Scroll further down this page to obtain CryptoCaster’s wallet addresses.

Thank you.

Kristin Steinbeck

Editor, CryptoCaster

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt

CRYPTOCASTER HEATMAP