The banking industry would benefit from the closure of cryptocurrency providers due to Warren’s Digital Asset Anti-Money Laundering Act.

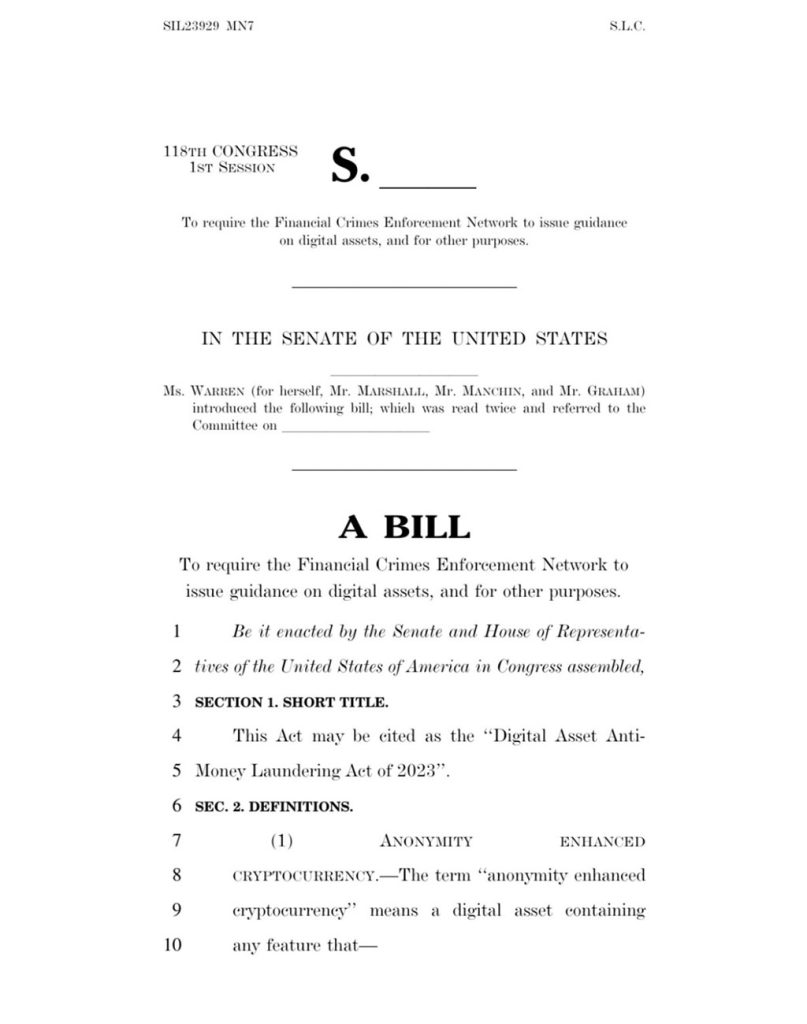

Senator Elizabeth Warren of Massachusetts tends to introduce a fresh draft of an anti-crypto law every time her last one fails to pass. She has the art of messaging bills down to a science; these are proposals that are submitted more for the aim of generating money and getting media attention than of actually passing legislation.

Stay in the know on crypto by frequently visiting Crypto News Today

The Digital Asset Anti-Money Laundering Act, one of Warren’s most recent pieces of legislation, poses a threat to the fundamental independence and individual sovereignty of cryptocurrency. Warren claims that her law is required to stop illegal activity, but a deeper examination shows that it may also hinder innovation, jeopardize user privacy, and benefit large banks.

CryptoCaster Quick Check:

Senator Roger Marshall of Kansas is a co-sponsor of the bill, which is predicated on the idea that cyber assets are being utilized more and more for illegal purposes like money laundering, ransomware attacks, and financing of terrorism. Although some unscrupulous individuals take advantage of digital assets, the bill’s methodology, which regards wallet providers and developers alike as possible criminals, is not only hazardous but also unrealistic.

The need that digital asset creators adhere to Know Your Customer (KYC) guidelines and the provisions of the Bank Secrecy Act (BSA) is the most hazardous aspect of the measure. This essentially transfers the responsibility for law enforcement to software developers. It would be similar to making automakers answerable for the way their cars are driven.

The law also aims to do away with privacy safeguards that shield cryptocurrency users from dishonest parties. Warren’s proposal jeopardizes law-abiding citizens’ privacy rights by clamping down on digital asset mixers and technology that enhance anonymity. It’s critical to keep in mind that privacy is an inalienable right rather than a privilege that may be waived at will. The transparency of the Bitcoin blockchain has directly led to the kidnapping and torture of several early Bitcoin billionaires. Warren would render Bitcoin users invulnerable to similar attacks in the future.

Even while she says she is acting in the interest of national security, it is important to remember that the major banks stand to gain a great deal by restricting the competition that cryptocurrencies present. The law would make it impossible for cryptocurrency to compete on an even playing field by implementing burdensome rules.

However, what about the claim that criminal groups and rogue states are using digital assets? It’s important to distinguish between the technology itself and the conduct of a select few, even though this is a legitimate issue. One could make the same case for money, which has long been utilized for illicit purposes. Just as too severe rules on cryptocurrencies are an overreaction, banning cash would be the same.

The bill’s treatment of “unhosted” digital wallets, which let users get around anti-money laundering (AML) and sanctions procedures, is one area of significant concern. Although stopping illegal transactions is important, the bill’s proposed rule, which would force banks and money service providers to confirm the identity of their clients and submit reports on specific transactions involving unhosted wallets, can have unforeseen repercussions.

Enforcing customers to divulge personal information during every transaction goes against the privacy and pseudonymity ideals that have attracted people to cryptocurrencies. Finding a balance between personal freedoms and security is crucial. Overregulation may cause users to migrate from regulated to more difficult-to-track unregulated sectors.

Furthermore, it appears that the bill misunderstands the fundamental principles of blockchain technology in its focus on ordering the US Financial Crimes Enforcement Network to provide guidelines on reducing the risks associated with managing anonymous digital assets. Cryptocurrencies such as Bitcoin are intended to be anonymous but transparent. One of the main characteristics that make blockchain secure and user-friendly is jeopardized when this pseudonymity is attempted to be eliminated.

Advertisement

Follow GappyCoin PreSale on Twitter, and ReCap for information and more.

The possible overreach in expanding BSA regulations to cover digital assets is another important problem. It might be overly burdensome for anyone who trade more than $10,000 in digital assets through offshore accounts to be required to file a Report of Foreign Bank and Financial Accounts (FBAR). It might cause needless difficulties for people who use digital assets for investments or cross-border remittances, among other legal uses.

Warren’s measure tackles a complex issue with a sledgehammer method. Targeting particular criminal actions and individuals would be a more balanced strategy than impeding innovation and privacy. The AML system that big cryptocurrency exchanges adhere to now works well to prevent the use of cryptocurrency illegally, which is why there have been sporadic reports of it.

The Digital Asset Anti-Money Laundering Act is a statute that has many serious problems. The cryptocurrency community is seriously threatened by Warren’s measure, which also runs the danger of benefiting large banks. We must come up with a more sensible and workable strategy that takes care of the issues without limiting the possibilities of this game-changing technology.![]()

We hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting CryptoCaster’s journalism.

From Elon Musk, Larry Fink(BlackRock) to Jamie Dimon(JP Morgan Chase) a number of billionaire owners have a powerful hold on so much of the hidden agendas’ which eludes the public concerning the paradigm shift juxtaposed by cryptocurrency and web3 emerging technologies. CryptoCaster is different. We have no billionaire owner or shareholders to consider. Our journalistic efforts are produced to serve the public interest in crypto development and institutional disruptions – not profit motives.

And we avoid the trap that befalls much U.S. and global media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality and retail consumer protection. While fairness and transparency dictates everything we do, we know there is a right and a wrong position in the fight against fiat global banking interest and monetary reconstruction precipitated by the emerging crypto ecology.

When we report on issues like the FTX, Binance and Ripple crisis, we’re not afraid to name who or what is uncovered. And as a crypto sentinel, we’re able to provide a fresh, outsider perspective on the global monetary disruption – one so often missing from the insular American and European media bubble.

Around the world, readers can access the CryptoCaster’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news and information, or not.

We thankyou for the on-going support our readers have bestowed monetarily. If you have not considered supporting CryptoCaster, if you can, please consider supporting us just once from $1 or more of Bitcoin (satoshi) or Eth, and better yet, support us every month with a little more. Scroll further down this page to obtain CryptoCaster’s wallet addresses.

Thank you.

Kristin Steinbeck

Editor, CryptoCaster

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt

CRYPTOCASTER HEATMAP