Polygon’s list of high-profile partners is getting longer, with Disney, Starbucks and Robinhood already boarding its blockchain.

Polygon (MATIC) emerged as the best-performing asset among the top-ranking cryptocurrencies on Nov. 3 as the market’s attention turned to the latest Instagram and JPMorgan announcements.

Polygon in high-profile partnerships

Notably, Meta, the parent company of Instagram, named Polygon as its initial partner for its upcoming nonfungible token (NFT) tools that allow users to mint, showcase and sell their digital collectibles on and off the social media platform.

Stay in the know on crypto by frequently visiting Crypto News Today

Meanwhile, banking giant JPMorgan used Polygon to conduct its first live trade (worth about $71,000) on a public blockchain, marking a concrete step toward integrating cryptocurrencies into traditional financial frameworks.

MATIC, a utility and staking token within the Polygon blockchain ecosystem, rose over 13% to $0.985 after the announcements, accompanied by an uptick in daily trading volume.

MATIC’s upside move came as a part of a broader recovery rally across the crypto sector that started in mid-June. MATIC’s price has rebounded by more than 200%, a trend that will likely sustain in the coming months.

MATIC’s price nears cup-and-handle breakout

The first cue for MATIC’s bullish continuation comes from a classic technical setup.

On the daily chart, MATIC has painted a cup-and-handle setup, which comprises a U-shaped recovery followed by a downward drifting channel. The token is now eyeing a decisive breakout above the pattern’s neckline range (the red bar in the chart below) to reach $2.89, its primary upside target.

As a rule of technical analysis, a cup-and-handle pattern’s target is measured after adding the distance between the cup’s bottom and neckline to the potential breakout point. As a result, MATIC is now eyeing a 200% price rally by the end of Q1 2023.

Fundamentally, MATIC’s demand could keep growing, given Polygon’s growing NFT projects launched by mainstream companies.

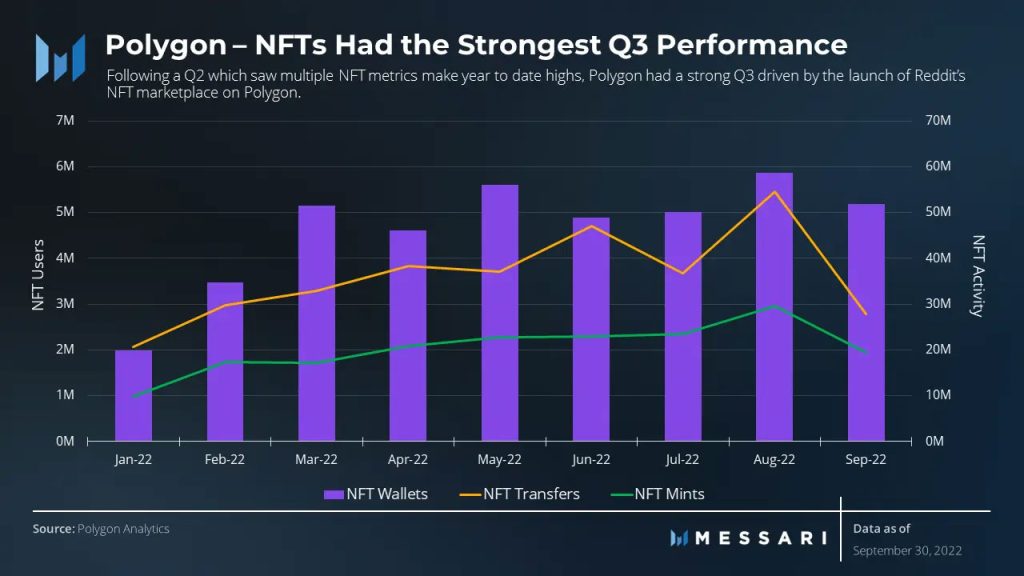

For instance, Polygon’s list of prominent NFT partners includes names such as Disney, Robinhood and Starbucks. Furthermore, Polygon had a strong Q3, wherein its number of active wallets reached a record high of 6 million, primarily driven by the launch of Reddit’s NFT marketplace on its blockchain.

On the other hand, macro risks continue to threaten the ongoing crypto market recovery, which may hurt Polygon despite its growing partnerships with big-name brands. That being said, a strong pullback from the cup-and-handle pattern neckline range could invalidate the bullish setup altogether.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.![]()

Read More at BITCOININSIDER

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt