Key Points

- Changpeng Zhao and Vitalik Buterin could develop an improved method for crypto exchanges to show proof of reserves.

- Binance will be the pilot for the solution, WuBlockchain said on Monday.

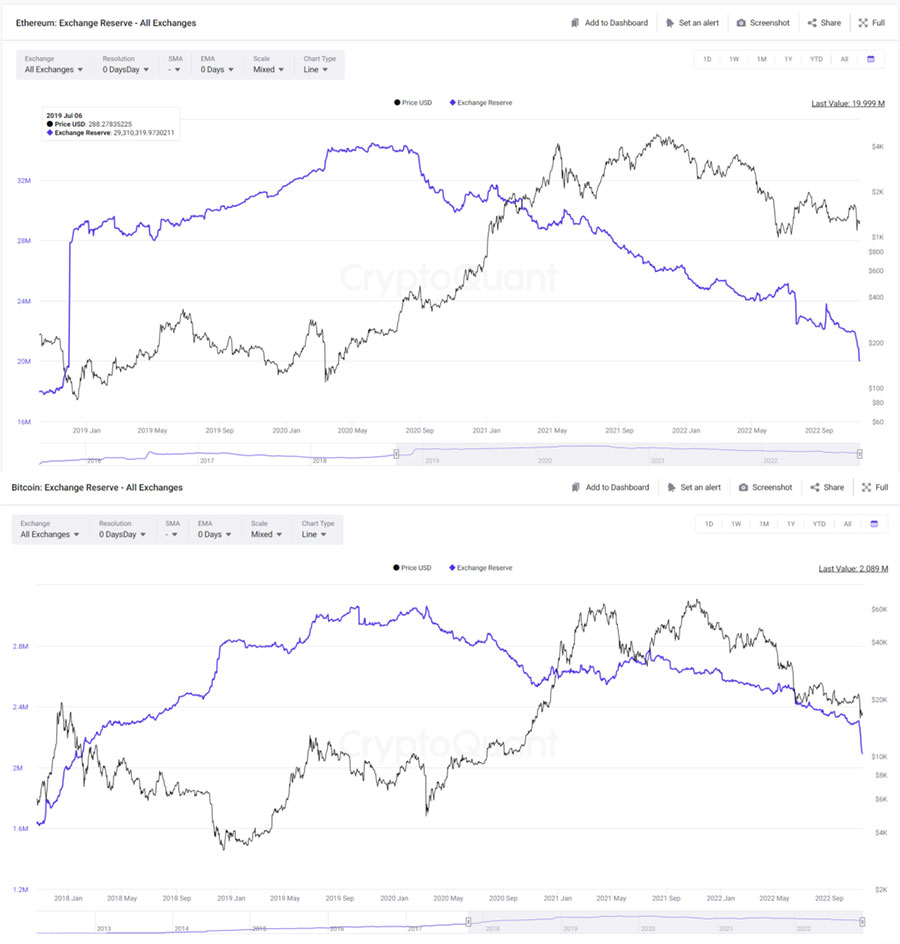

- Proof of reserves became a hot topic in crypto after Sam Bankman’s FTX was exposed as insolvent.

- Billions in virtual currencies flowed out of centralized crypto exchanges following the news.

Binance CEO Changpeng Zhao and Ethereum founder Vitalik Buterin could be working on a proof of reserve method for centralized cryptocurrency exchanges (CEX) following FTX’s failure. The development was shared by the WuBlockchain team who cited an AMA session held ear;ier.

Users Demand Proof of Reserve From Binance And Other CEXs After FTX Debacle

Indeed, proof of reserve for centralized CEXs has evolved into a major talking point within the crypto community. The conversation surrounding reserve proof arguably ignited after FTX collapsed, leaving millions of users without access to their funds and supposedly eroding confidence in centralized exchanges.

Stay in the know on crypto by frequently visiting Crypto News Today

After it was discovered that FTX had a balance sheet hole worth a few billions, crypto participants and users asked other exchanges like Binance and Coinbase to their solvency. Zhao’s exchange led the charge for exchanges to champion transparency and share their holdings using the Merkle-tree proof-of-reserves.

However, customers shared doubts since the disclosure from Binance did not include liabilities. Other exchanges like Bitfinex and ByBit saw stiff reception from users regarding their reserves. Crypto.com and Gate.io also drew heavy scrutiny due to Ether (ETH) transactions between the two exchanges.

Crypto.com CEO Kris Marszalek argued that the company’s “balance sheet is strong” and promised a full reserve. Coinbase, Kraken, and Gate.io have all released full audits including liabilities, per announcements from the platforms.

Users can also track exchanges’ reserves in real time using Nansen, CEO Alex Svanevik tweeted.

Outflows from CEXs continue to ramp up in the wake of the FTX crash despite efforts to bolster user confidence in these platforms. Data from Crypto Quant showed that CEX crypto balances dropped to levels previously seen in November 2018. Over $6 billion in Bitcoin (BTC), Ether (ETH), and Stablecoin left CEXs since November 6, per Crypto Quant’s dashboard.

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt