It has become nearly impossible to imagine a crypto world without the term decentralized finance, better known as DeFi.

The promise of DeFi is a better financial system. A system with less dependency on centralized parties, more efficient and more inclusive.

With new companies, protocols and applications being created every day, the DeFi space is growing rapidly. With a total value of $255 billion locked within DeFi protocols and several DeFi unicorns around, the industry is one to be reckoned with.

With all of this going on, one might easily forget that the DeFi industry is just a couple of years old. The term DeFi was coined for the first time in August 2018.

While both DeFi’s promise and growth are astounding, the road to success isn’t straight. Hiccups in DeFi’s growth spurt have become visible in the form of hacks and protocol exploits. According to Elliptic, around $10 billion was lost due to hacks and scams in 2021 alone.

Next to regulation and education, it can be argued that risk of capital loss is one of the main bottlenecks for widespread enterprise adoption of DeFi. If only there was a way to protect yourself against this?

Enter DeFi insurance. A nascent industry within a nascent industry, but nonetheless with immense potential.

Let’s take a look at what DeFi insurance is, how it works, when you should use it, and which companies provide it.

What is DeFi insurance?

DeFi insurance refers to insuring yourself, or ‘buying coverage’, against losses caused by events in the DeFi industry.

Suppose you’re an individual or a company with capital locked somewhere on a DeFi platform. As you’re aware of the fact that you might lose your capital if this platform or protocol gets hacked, you want to insure yourself against this risk.

You therefore go to a DeFi insurance provider and pay a certain amount in order to get covered in case you lose your capital due to a specific, predetermined event.

The premium you pay for a cover widely varies depending on the cover type, duration and provider. But to give an example, you pay 0.0259 ETH to cover 1 ETH for one year against a hack on Binance on Nexus Mutual (at the time of writing).

Of course it is quite important to understand which types of events you actually buy coverage for. Just like with any regular insurance, it is important that these events are very clearly specified beforehand.

Some examples of DeFi insurance are: exchange hacks, attacks on DeFi protocols, smart contract failures, or stablecoin price crashes.

How does DeFi insurance work?

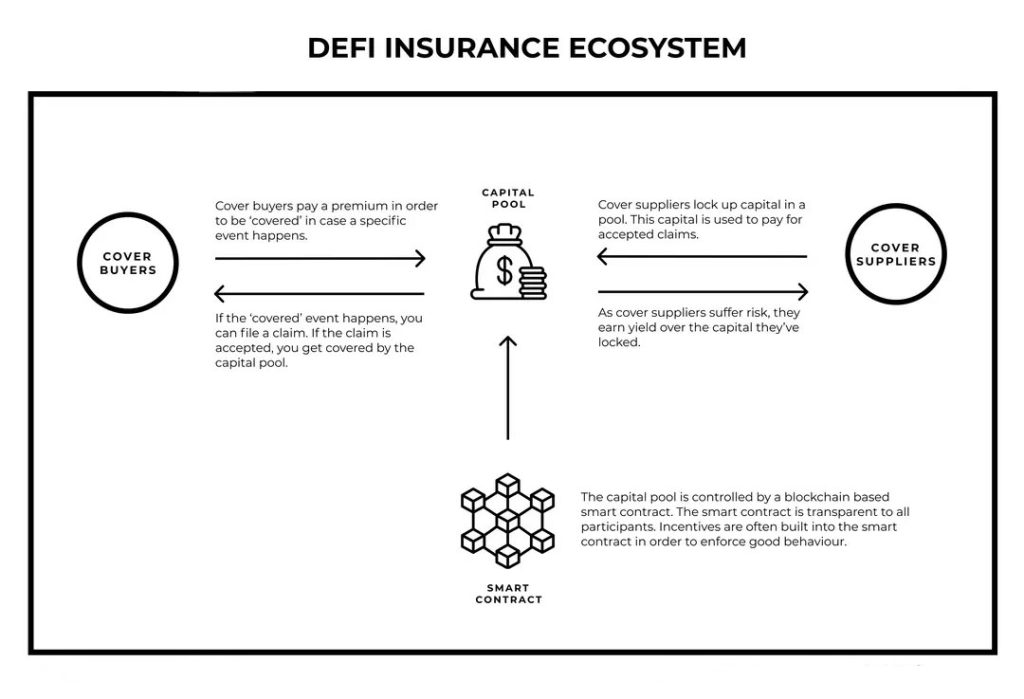

DeFi insurance wouldn’t honor its name if it didn’t happen in a decentralized way. Instead of buying coverage from a single person or company, you buy coverage from a decentralized pool of coverage providers.

Anybody can act as a coverage provider. You do so by locking up capital in a so-called capital pool. By doing so, you effectively become a liquidity provider.

As a coverage provider, you choose for which events or protocols you want to provide coverage. You might, for example, be very certain that exchange X will not be hacked. You are therefore fine with providing liquidity to the capital pool which covers that specific event.

Should exchange X still be hacked, the funds in that capital pool will then be used to cover the claims from people who bought coverage against a hack.

As a coverage provider, you are of course exposed to risk. That is why you earn interest on the capital you lock up as a coverage provider. This interest is often (partly) paid for using the coverage buyers’ premium.

How are claims verified?

This all sounds great, but there is another very important aspect: who decides if a claim is valid?

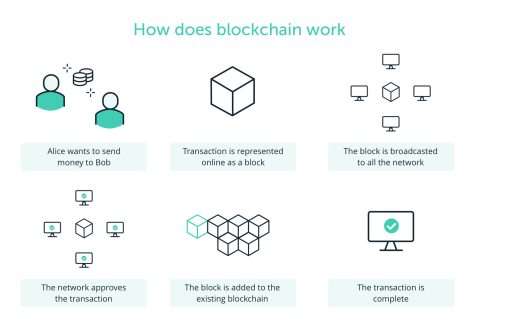

Often, this is done by the community itself. DeFi insurance protocols are frequently set-up using a DAO (Decentralized Autonomous Organization) structure.

In such a structure, holding the token associated with the insurance protocol gives you governance rights. Meaning you can participate in voting to accept or deny claims.

Sometimes claims are automatically verified, instead of by community voting. This is often done with the help of so-called ‘oracles’. Simply put, oracles are decentralized information mechanisms which verify external data.

Oracles can be set up to accurately track the outcome of certain events, and distribute this information across the internet. This can be useful for DeFi insurance protocols, as chances of a dispute will be minimized.

Putting it all together

Let’s summarize all of this. Simply put, DeFi insurance works as follows.

- You buy coverage against a specific event. This ensures you are protected against capital loss due to this event. The premium you pay for this coverage depends on multiple factors such as the coverage duration, covered amount, and the covered event.

- On the other side are coverage providers. They ‘underwrite’ your risk, meaning that they cover you in case the underwritten event happens. Coverage providers therefore suffer risk, and earn interest on the capital they provide. Anybody can act as a coverage provider.

- If you believe you lost capital due to a covered event, you can file a claim. Different insurance platforms use different methods to verify claims. Sometimes it happens through a community vote, while other times it happens in an automated way. If your claim is accepted, you will be reimbursed for the amount you bought coverage for.

What’s next for DeFi insurance?

As mentioned earlier, the DeFi insurance industry is a very nascent one. With many billions of dollars locked up in DeFi protocols however, it seems inevitable that DeFi insurance will grow in popularity.

With only 2% of all DeFi value being insured, there is a massive gap to be filled. Companies are all too eager to jump in on this gap, and create solutions to make the DeFi world a safer place.

Looking into the coming years, we see more DeFi insurance companies / protocols being created, more coverage options emerging, and more DeFi value being insured.

Please Read Essential Disclaimer Information Here.

© 2024 Crypto Caster provides information. CryptoCaster.world does not provide investment advice. Do your research before taking a market position on the purchase of cryptocurrency and other asset classes. Past performance of any asset is not indicative of future results. All rights reserved.

Contribute to CryptoCaster℠ Via Metamask or favorite wallet. Send Coin/Token to Addresses Provided Below.

Thank you!

BTC – bc1qgdnd752esyl4jv6nhz3ypuzwa6wav9wuzaeg9g

ETH – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

MATIC – 0x7D8D76E60bFF59c5295Aa1b39D651f6735D6413D

LITECOIN – ltc1qxsgp5fykl0007hnwgl93zr9vngwd2jxwlddvqt

Support CryptoCaster with any amount of Bitcoin by copying and pasting our Unstoppable Domain; villagewest.crypto in your sending wallet or crypto coin exchange.

Your contribution support will help in our growth, coverage, and global presence. CryptoCaster is a decentralized publisher “Covering a Global Evolution Re-defining Mediums Of Exchange”. We will continue to upgrade and create impactful sections to our lineup.

Any amount, as often as you can contribute will be greatly appreciated.

Every contribution, however big or small, is so valuable for our future. Thank you for your consideration and support!

Member of Global Meta Media Consortium℠ – www.g2mc.world